Guest blog: Handful of companies dominate public sector EV charging market

The UK public sector is relying on a small group of suppliers to deliver the roll-out of EV charging infrastructure, new analysis finds.

A new report produced by Tussell - a public sector market intelligence provider - used data on government EV Chargepoint (EVCP) contracts since 2013 to identify which companies have been awarded the most work in this growing market.

Data shows that just 10 companies have won 73% of all government EVCP contracts since 2013.

This is despite a significant influx of new suppliers entering the market in recent years.

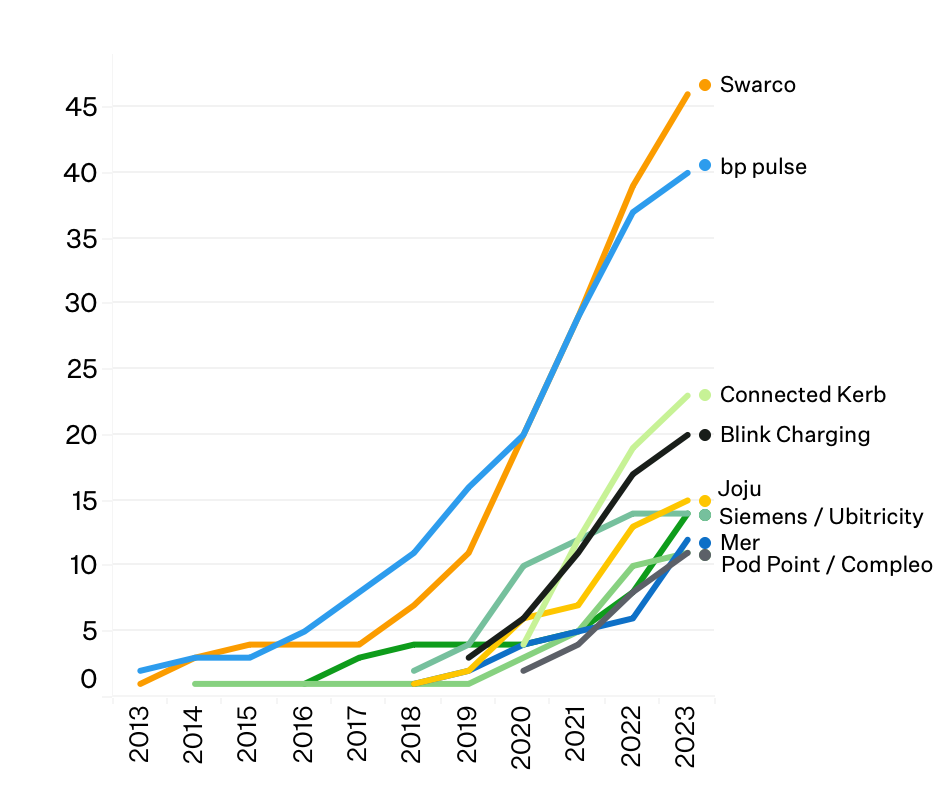

Cumulative volume of EVCP contracts won by the top 10 suppliers

Austrian firm SWARCO leads the pack, winning 46 individual EVCP contracts as of December 2023.

Bp pulse - a subsidiary of BP - follows at a close second, with 40 contracts.

Other members of the top 10 include Connected Kerb, Blink Charging, Joju Charging and Siemens.

Just 4 of the top 10 EVCP providers are headquartered in the UK. The same proportion are owned by an energy company.

The report shows that these suppliers are capitalising on a fast-growing subsector of UK public sector procurement.

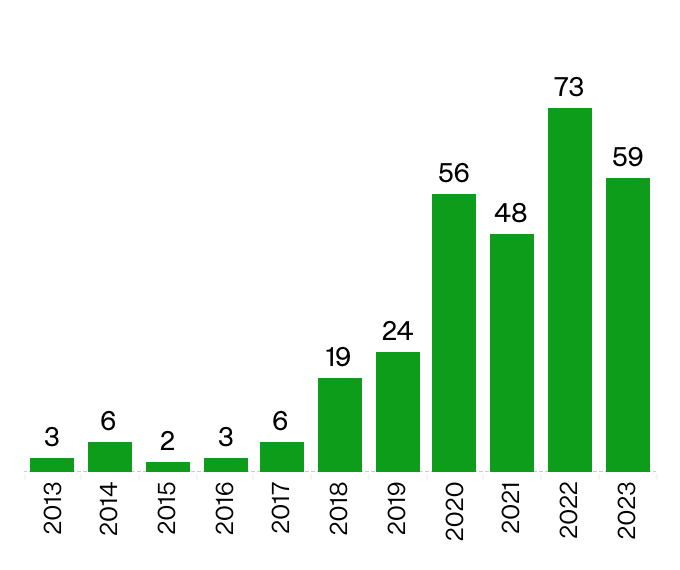

The volume of EVCP contracts awarded by public authorities grew by 20x between 2013 and 2023. Nearly three-quarters of these originated from Local Government.

Volume of EVCP contract awards

“All EV Charging infrastructure providers and consultants should have their eye on the public sector market”, argues Lloyd Johnson, Tussell’s COO.

“The average number of EVCP units awarded per public sector contract currently sits at 55. If the new government is to meet the prior administration’s target of having at least 300,000 public EV Charging stations nationwide by 2030, a staggering 4,474 new EVCP contracts would need to be awarded in the next six years. It’s safe to say that significant growth in this market is expected.”

Labour’s 2024 general election manifesto suggests the new government will stick to - or even accelerate - this target. The manifesto pledged to “support the transition to electric vehicles by accelerating the roll-out of charge points” and to restore “the phase-out date of 2030 for new cars with internal combustion engines”.

If the current trajectory continues, Tussell predicts that the UK public sector EVCP market could be worth up to £3.3bn by 2030.

A key reason why the 10 largest suppliers have managed to acquire such a large share of the market is their use of framework agreements and Dynamic Purchasing Systems (DPSs).

These pre-approved supplier lists facilitate the awarding of new contracts across the public sector. A quarter of all EVCP contracts were awarded via these agreements since 2013.

Notably, the five most-used agreements are being heavily utilised by the 10 leading suppliers.

“If hopeful suppliers want to succeed in this marketplace, they would benefit from closely analysing the top 10’s public sector sales strategy. See which frameworks they’re on, which areas of the public sector are awarding them the most work, and combing through the specifics of their awarded contracts.”

To download Tussell’s new EV Charging market report, head over to their website, or get in touch with their team at [email protected]

Smart Infrastructure and Systems updates

Sign-up to get the latest updates and opportunities from our Smart Infrastructure and Systems programme.