NHS Budget Directory: Confirmed budgets allocated to Integrated Care Systems

Guest blog by Dilem Tekan, Growth Associate at Stotles

Public sector sales-enablement tool Stotles has released a free NHS Budget Directory offering a consolidated view of Integrated Care System funding sources, budget allocations and procurement plans this fiscal year.

ICS Budgets in 2023/2024

39 of England’s 42 Integrated Care Systems (ICSs) have published Capital Resource Plans, revealing funding sources, capital allocations and confirmed projects for 2023/2024. Within these Capital Resource Plans, ICSs reveal their "Capital Departmental Expenditure Limit" (CDEL), essentially a combined total budget for the fiscal year.

To help you understand the funding available across the NHS, Stotles have ranked ICSs by their CDELs below.

Download the full report to access detailed budget summaries for every ICS, including: funding sources, capital allocations and upcoming procurement plans.

Demystifying Capital Resource Plans

To help you understand how these budgets are allocated to authorities within each ICSs, this section provides explanatory notes on North West London's capital breakdown as an example case.

Spotlight on North West London

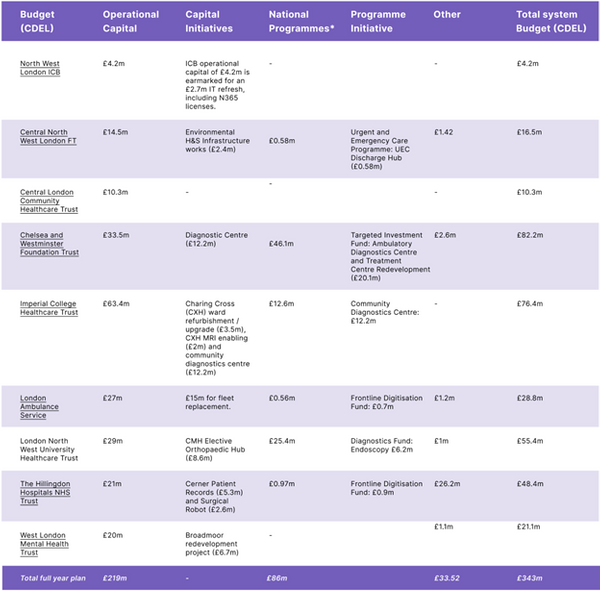

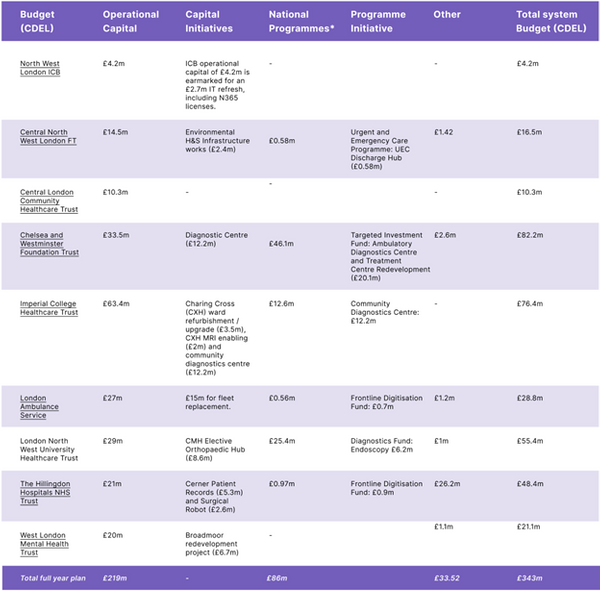

With a CDEL of £343m, North West London (NWL) boasts the largest budget of London's 5 ICSs in 2023/2024.

Responsible for equitably distributing capital to the 9 Trusts across their ICS, North West London's Capital Resource Plan reveals how the ICB will allocate funding in the 2023/24 fiscal year.

North West London ICS has a total CDEL of £343m, including £219m of Operational Capital, £86m from National Programme funding and £26m from New Hospital Programme & upgrades.

These funding sources are explained below.

Operational Capital:

NHS trusts use this budget to support ‘business as usual’ schemes, such as backlog maintenance, equipment replacement and IT expenditure. NHS England provide ICB's a capital allocation at the start of the financial year. ICB's are then responsible for distributing it to member trusts based on the needs of their population.

Suppliers working in Medical Technology and IT & Software can target authorities based on these budgets allocations.

National Programmes:

National Programme funding is held centrally by NHS England, directed towards trusts priority projects like Targeted Investment Fund, Frontline Digitisation, Diagnostics and Mental Health, among others.

Other:

Other funding includes technical accounting adjustments such as PFI residual interest and the Impact of IFRS 16. In some cases, funding that falls into "Other" may also include small donations, or peppercorn leases.

Total Capital Departmental Expenditure Limit (CDEL):

A CDEL is essentially a total system budget. It is the sum of operational capital, national programme funding and other technical accounting metrics.

To help you visualise this funding, we have provided an infographic of the capital allocation in North West London below.

Procurement opportunities in North West London

As well as confirming funding sources and allocations, Capital Resource Plans also reveals major projects that have received funding for the upcoming year. This section provides further detail on projects funding has been allocated for, and highlights confirmed procurement opportunities that suppliers can pre-engage over.

Ongoing Schemes

- Urgent & Emergency Care (UEC) for the ICS held at CWFT (£26m).

- Front Line Digitisation at THH (£1m) and LAS (£0.7m);

- Community Diagnostics Centre LNWHT (£19.2m) and Imperial (£12.2m);

- Diagnostics Digital Capacity Imperial (£0.4m,)

- Endoscopy LNWHT (£6.2m);

- Targeted Investment Fund (TIF) - Ambulatory Diagnostics Centre and Treatment

- Centre Redevelopment (£20.1m) CWFT.

- Mental Health UEC - Discharge lounges CNWL (£0.5m)

Upcoming Business Cases

- WLMH: Full Business Case (FBC) for Broadmoor. Relates to 2024/25.

- THH – New Hospital Programme (Outline Business Case stage).

ICS Budget Summaries:

The remainder of Stotles NHS Budge Directory provides similar budget summaries and confirmed procurement projects for the remaining 38 ICSs.

To download the full report, click here.

Groups

techUK has launched a Life Sciences workstream, bringing together members actively working in drug discovery, digital therapeutics, data and AI, or those interested in moving into this space. As the Life Sciences sector looks to introduce digital health technologies into its portfolio, techUK are shaping the conversation.

The Interoperability Working Group will work towards achieving the vision set out in NHS England’s 2022 draft standards and interoperability strategy.

The group will aim to encourage the adoption of open standards and fluidity of data whilst recognising the commercial needs of members.

It will also focus on demonstrating the value of interoperability to NHS senior management and improving the abilities of SMEs to implement interoperability standards.

Find out more about our work to shape the digital social care marketplace and how our members are innovating across the industry.

Health and Social Care updates

Sign-up to get the latest updates and opportunities from our Health and Social Care programme.

Authors

Dilem Tekan

Growth Associate, Stotles