techUK welcomes G7 Global Tax Agreement

On 5 June G7 Finance Minister’s agreed on agreed the principles of a two Pillar global solution to update the global tax system so that it is fit for the modern era.

Under the first pillar, the largest and most profitable multinationals will be required to pay tax in the countries where they have operations. These rules would apply to global firms with at least a 10% profit margin – and would see 20% of any profit above the 10% margin reallocated and then tax paid on these in the countries where the business operates.

The UK Government has said “this fairer system will mean the UK will raise more tax revenue from large multinationals and help pay for public services here in the UK”.

Agreement on Pillar One also saw a commitment from G7 countries coordinate on the removal of national digital services taxes when a new global regime comes is applied.

Under the second Pillar the G7 Finance Ministers also agree on the principle of a 15% global minimum corporation tax.

techUK has long advocated for a global solution to the taxation of multinational. This is a significantly more effective way to tax companies in the modern economy versus national digital services taxes which have resulted in serious trade disputes and penalise companies for achieving growth using business based on the use of digital services.

The full Communiqué from G7 Finance Ministers and Central Bank Governors issued on 5 June can be found here, while a press release form the UK Govermment can be found here.

techUK has welcomed the announcement of the deal at the G7. While further negotiations will be needed at the OECD and in other multilateral forums to turn this into a truly global agreement, this is a significant step.

techUK will also continue to work closely with the UK Government and the OECD on the details of any proposal, getting the detail right will be hugely significant to ensuring an effective and fair regime.

A previous call to action by techUK and other tech sector trade associations for a global agreement can be found here.

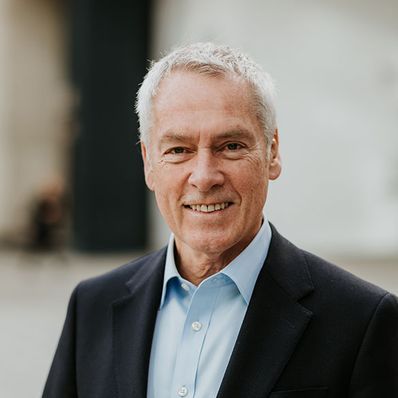

Responding to the announcement by the G7 Finance Ministers, techUK CEO Julian David said:

“This is a welcome announcement from the G7 and while further negotiations will be needed to achieve a global agreement this is a truly significant step in the right direction.

techUK and our members have long called for a global solution to the taxation of multinational companies with this being the best way to ensure tax is distributed fairly and we avoid the trade conflicts and disputes that have resulted from national digital services taxes.

I also would like to welcome the leading role the UK Government has played in this process, and I look forward to working with the Chancellor and his G7 counterparts on the details of this proposal.”